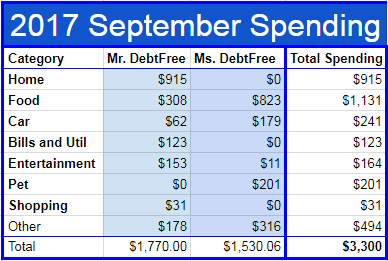

In an effort to keep things simple, we break all of our spending into 8 categories.

Home - our mortgage, taxes, and insurance, as well as any house upgrade items.

Food - this includes all groceries, restaurants, alcohol, household goods from grocery stores, etc.

Car - gas, insurance, licensing fees, etc.

Bills and Util - water, electricity, natural gas, internet, and garbage.

Entertainment - travel, Netflix, Amazon Prime, and any other fun activities.

Pet - food, toys, vet bills, medication. anything related to our fluffy (dog) and feathered (parrot) friend.

Shopping - random shopping expenses, clothes etc.

Other - this is the catch all category for things that don't fit easily into the other 7. We use this category for expenses that we do not share with each other. Examples would be things like haircuts, prescription medications, gifts, etc.

Overall spending for the month of September was $3,300. Because this is our first month tracking expenses we will use this as a baseline for future months. Quickly glancing at our spending we can easily spot areas for improvement.

Our biggest expense was food, coming in at $1,131. This is an extremely high number for two adults! Going forward I would like to reduce this to under $800 for future months. The majority of this spending comes from eating out too much, partially because we took a 3 day vacation to the coast. While $800 is still a large food budget, I want to step it back in increments so we can gauge if reducing this expense affects our happiness levels.

Both home, and bills and utils were very low this month. I pay $915 every month for my mortgage and we did not have a water, or garbage bill due this month as they are bi-monthly. Our pet and auto spending were higher than usual this month as we had to stock up on food, prescriptions for our aging pup, and dog treats. The food and treats should last 2-3 months which will cause this expense to be lower in future months. Our parrot is low maintenance financially, but he makes up for it in emotional neediness. For the auto portion, we both own our vehicles outright so our spending is mostly just gas (traveling to and from the coast is ~300 miles round trip) and insurance. I walk ~ 4 miles round trip to and from work each day, and Ms. DebtFree has a ~6 mile round trip commute which keeps driving expenses low.

Our entertainment spending was slightly above average this month due to our 3 day trip to the coast. The ocean breeze seems to magically extract our built up stress and I foresee this being a regular monthly or every other month trip for us. We will challenge ourselves to reduce this cost by camping at the coast instead of staying in hotel rooms every single trip.

This month's "Other" category was dominated by 4 birthdays. Ms. DebtFree turned 26, and three other family members also added to their high scores. This expense should be at least $250 smaller on average.

Based on our spending this month I am challenging us to spend less than $2,700 for the month of October. Making a few small adjustments to our spending levels will provide an additional $600 per month to tackle debt. Here are the steps we will take to get there:

- Reduce Food spending from $1,131 to $800. Savings of $331.

- Reduce Pet from $201 to $50. Savings of $151.

- Reduce Other from $494 to $250. Savings of $244.

- Bills and Utils should go up $150 for water and garbage expenses. Increase of $150.

- We will try to hold Entertainment to $100. Savings of $64.

That's it for September. I look forward to seeing you all for our October update!

No comments:

Post a Comment