What Happened?

My debt journey began with an impatient young adult (me) who delayed starting college for a few years because of unexpected health issues. I could have made smarter decisions back then. I could have managed living at home for another year or two, although it was not an ideal environment. I could have continued working my part-time job, continued saving and planning for a big move, and simply continued waiting on college. But, I didn’t do any of those things. Instead, I was so impatient to get started that I signed my life away in the form of both subsidized and unsubsidized loans.

For loan newbies, subsidized don’t accrue interest while you’re enrolled in college and unsubsidized do accrue interest. On top of the loans in my name, my mom and I made the piss poor decision to pull Parent PLUS Loans in her name to cover books and cost of living expenses. At the time it seemed like a good idea. I needed to take the next step in life and I didn’t qualify for decent financial aid because of my age. My dad was also continuing to claim me as a dependent on taxes, but that’s a frustrating story no one wants to hear! My parents were separated and my mom and I were sharing expenses. We figured hey, no big deal, I could easily pay off these loans after I graduated as a nurse.

Seriously??

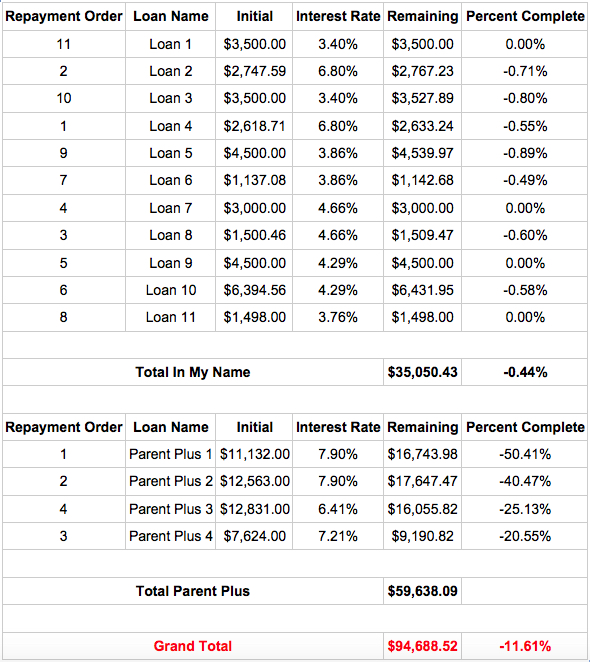

Sometimes I wish I could go back and shake the younger me and tell her to do even the most basic research about personal finance. Those “no big deal” loans now total $95,000. Yep, almost one hundred grand in student loans for an undergraduate nursing degree. On one hand these loans enabled me to reach my goal of becoming a registered nurse. On the other hand, these same loans have thrown a major curve ball at my life goal of being financially independent.

|

| Diploma in hand and ready to |

What's Next?

Moving forward, I am trying not to dwell on past decisions and beat myself up over poor planning. It happened: I made those choices and now I have these loans. Period. No time machine fantasy is going to change it. The healthiest way to cope with my debt is to stay optimistic while I form and enact a better plan. Step one was to get a job and pass my board exam. Done and done. The next step is to build an emergency savings fund. That step is “in progress” since I am about three paychecks into my new job. My next step is to start tackling my student loans and the Parent Plus Loans using a systematic approach that considers both the individual loan amounts and the interest rates.

My Support System

At this point I think it’s important for me to give credit to Mr. DebtFree for developing my personalized DebtFreeDuo Roadmap to Financial Independence -and yes, I totally pulled that name out of my you know what! In the almost three years we’ve been together, he has taught me so much about budgeting, financial security, retirement planning, and living within your means. His support helped pull me out of my “Eeyore attitude” many times as I’ve taken a closer look at my total loan amount. Gratitude is an unending process in life and it’s easy to be discouraged when you have significant debt. There isn’t some big secret to happiness. All you really need to do is seriously evaluate what you want out of life, start mapping out how to get there, and then follow your map. And everyone’s map will look different. No two roads will be exactly the same. Some people might even float down a river, which is what I imagine winning the lottery would amount to on a map!

|

| Tip: take an art therapy break when talking about debt stresses you out! |

Staying On Track

Okay, where were we? Loans. My debt isn’t pretty and it’s not super fun to talk about. But we have a plan to conquer my debt and we want to share it with you. Part of my writing is to encourage myself to keep chipping away at my loans until they’re gone. Let’s be real though. A lot of this blog is for personal accountability. Even if no one ever reads a single post, I’ve put it all out there. My debt, my spending, and my savings. Transparency is important for me. Coffee is life and my bank account has taken more than a few hits to support this philosophy! It’s like we say in nursing: if you didn’t document it, you didn’t do it. So here is my documentation. These are my loans, this is my spending, and this is my path to financial independence. My goal is to be as optimistic about my future as I can, even when I’m having a “poor me” kind of day. I really do love my life and I hope my posts keep me focused on my DebtFreeDuo Roadmap.

As some of my hometown friends would say: thanks for listening, y’all have yourselves a good day now!

My Loans Today

No comments:

Post a Comment